Home Office Deduction 2024 Self Employed Meaning – If you worked remotely in 2023, you may be curious about the home office deduction. Here’s who qualifies for the tax break this season, according to experts. . Top tax write-offs for the self-employed The home office deduction allows you to deduct However, that doesn’t mean every expense during a business trip is deductible. For example, if you .

Home Office Deduction 2024 Self Employed Meaning

Source : quickbooks.intuit.comThe Home Office Deduction TurboTax Tax Tips & Videos

Source : turbotax.intuit.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comIRS Form 2441: What It Is, Who Can File, and How to Fill It Out

Source : www.investopedia.comMMS Accounting Solutions

Source : www.facebook.comIndependent Contractor: Definition, How Taxes Work, and Example

Source : www.investopedia.comHere’s who qualifies for the home office deduction for 2023 taxes

Source : www.cnbc.com17 self employed tax deductions to lower your tax bill in 2023

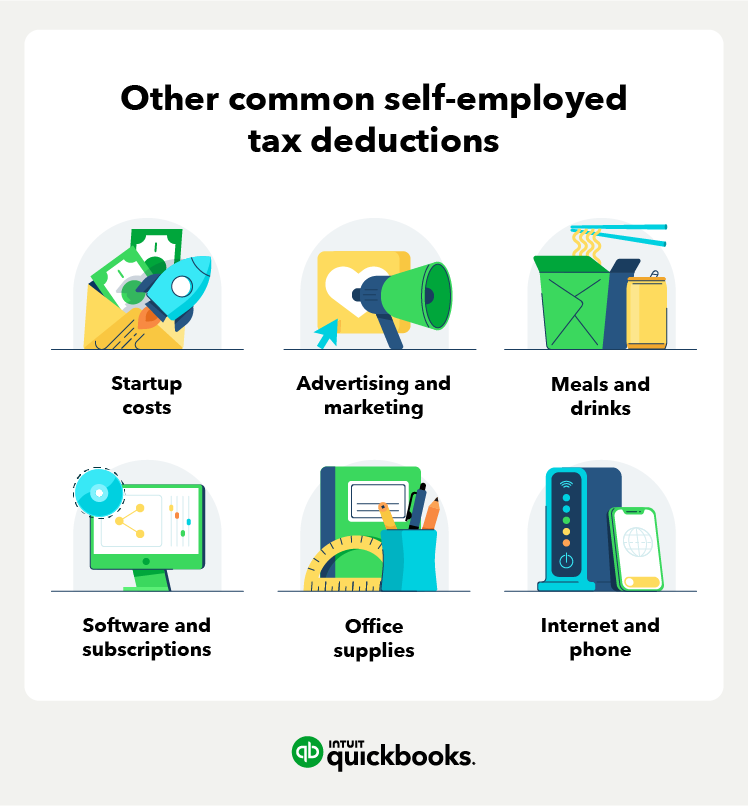

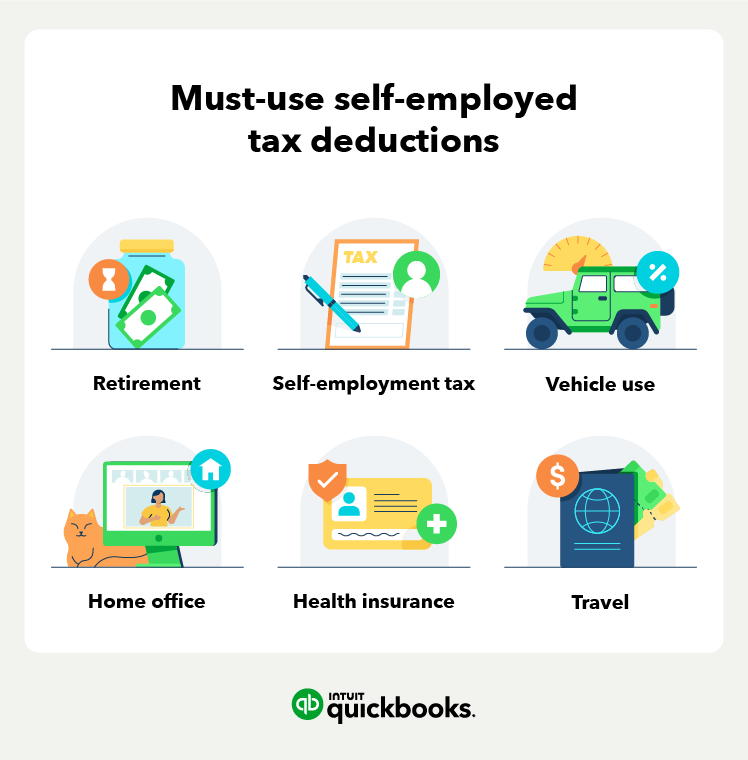

Source : quickbooks.intuit.comTurboTax® Premium Online 2023 2024 | Self Employed & Investor Tax

Source : turbotax.intuit.comHome Office Deduction 2024 Self Employed Meaning 17 self employed tax deductions to lower your tax bill in 2023 : But can the remote work setup also include tax deductions must use your home office area regularly and exclusively for your self-employed business.” This doesn’t necessarily mean you have . A forgotten self-employed tax credit could mean ‘serious money,’ but the deadline to apply is fast approaching. .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

:max_bytes(150000):strip_icc()/form-2441-child-and-dependent-care-expenses-definition-4783504-final-0464752338624545a391b2f2db97b354.png)

:max_bytes(150000):strip_icc()/independent-contractor.asp-FINAL-6904c017dfbf4da18e90cf4db4af91e7.png)